The Central Bank Of Nigeria launched the Bank Verification Number in 2014, about 6 years ago, in order to reduce illegal banking transactions in Nigeria. It is a modern security measure in line with the Central Bank of Nigeria Act 1958 to curb fraud in the banking system. It would amplify transparency and credibility in the financial sector.

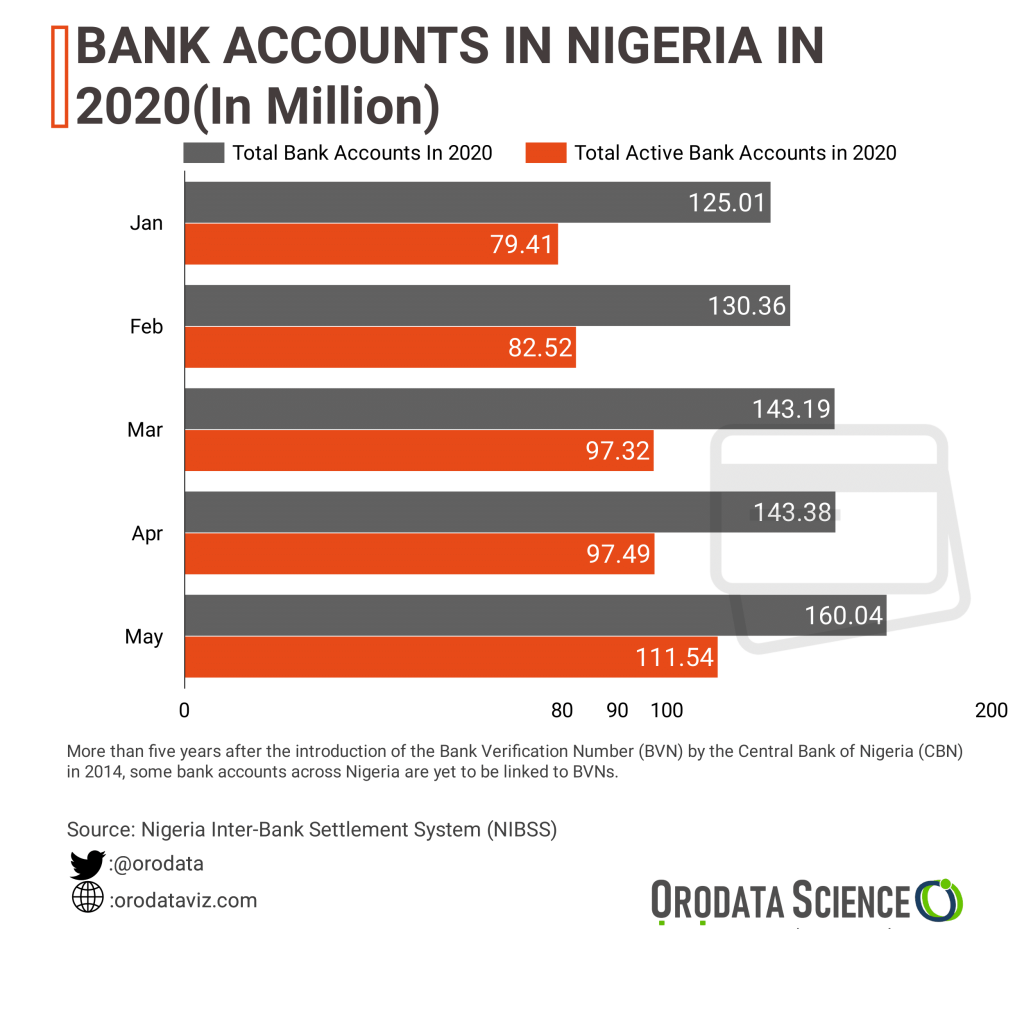

CBN had set a deadline for all banks customers to have their accounts linked to BVN in October 2015, in which you will not be able to access your bank accounts if your account is not linked with BVN, yet in 2020, about 71 million customers still use their accounts without the compulsory identification, per data from the Nigeria Inter-Bank Settlement System (NIBSS).

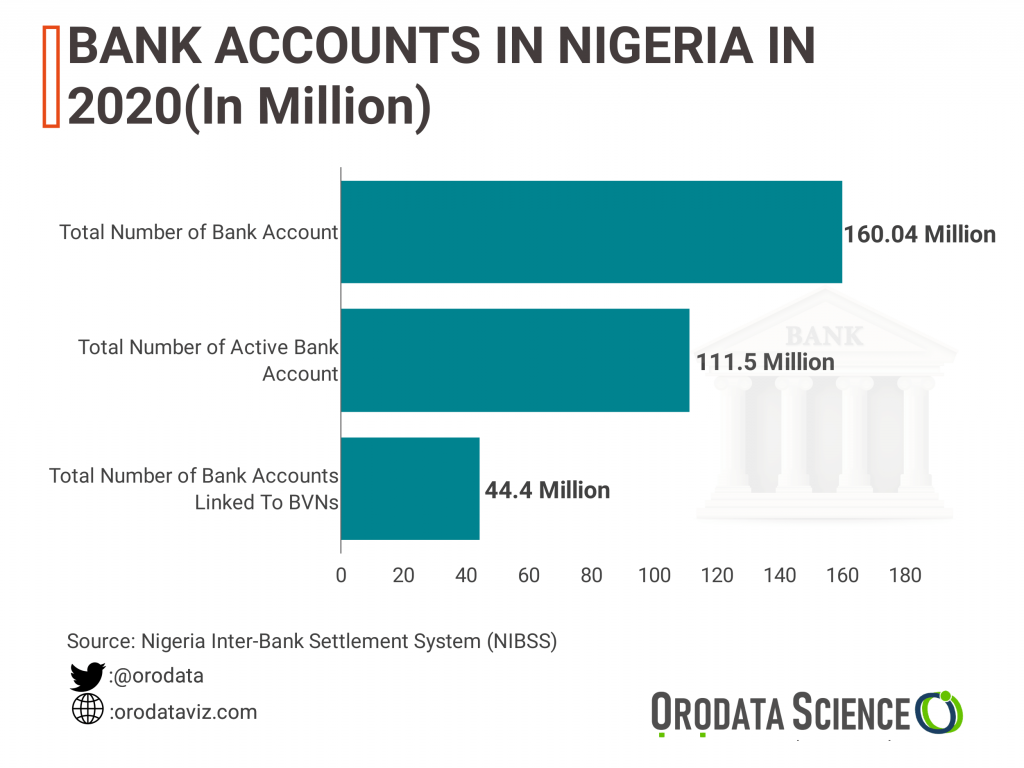

According to the data from the NIBSS as regards the bank accounts statistics in Nigeria since May, only 44.64 million bank accounts were linked with BVN out of the 111.5 million total active bank accounts. This means only about 38% of the total active bank accounts were linked with a verification number.

The BVN is seen as an important tool to fight corruption or fraudulent acts by account holders, as every individual can be traced through their details with the bank. Without full implementation of the BVN project, it would be difficult to expose questionable sources of wealth such as the ones from a crime like kidnapping and theft of public funds.